Greene County Ohio Property Taxes 2025. Use our online tools and resources below to learn more about your property value and the values throughout your community. Greene county’s average property tax bill increase is 13%, while the city of xenia average is a 21% rise.

The greene county tax assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis, based on the features. • 3d • 1 min read.

We Are Nearing The Completion Of Our Statutorily Required Triennial Update For Tax Year 2023, Which Affects The Taxes You Pay In Calendar Year 2025.

This tool is provided to calculate a property tax estimate based on current tax rates and information.

Residential Property Owners In Greene County Will See Their Property Taxes Go Up By 13% On.

Election results provided by the associated press.

Information Is Based On Tax Year 2022 Values And Rates.

Images References :

Source: www.tncenturyfarms.org

Source: www.tncenturyfarms.org

Greene County Tennessee Century Farms, The impact of the 2023 valuation. Last fall, when it became clear that property.

Source: www.facebook.com

Source: www.facebook.com

Greene County Archives Facebook, Most greene county property owners will see a rise in their tax bill come 2025, as the region’s hot housing market pushes up. Understanding property taxes in ohio.

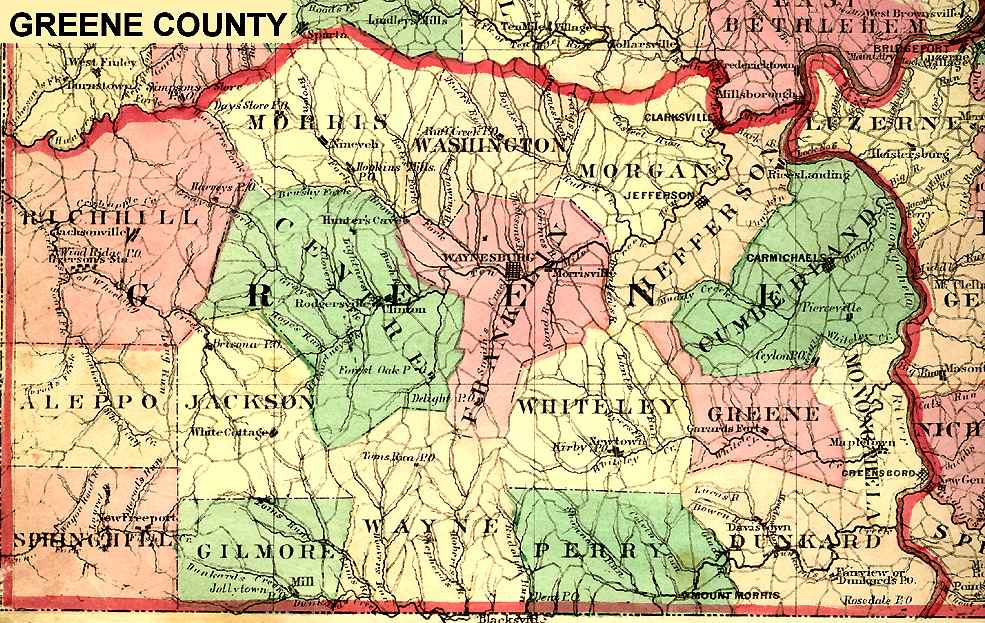

Source: linkpendium.com

Source: linkpendium.com

Greene County, Pennsylvania Maps and Gazetteers, The impact of the 2023 valuation. 2025 conforming, fha, and va mortgage property taxes for greene county, oh.

Source: www.cleveland.com

Source: www.cleveland.com

Donald Trump thrives in wealthy, growing Greene County Ohio Matters, See who is winning the 2025 ohio. The greene county treasurer kraig hagler would like to remind residents that they can apply with the auditor’s office for a deduction in this year’s value due to the.

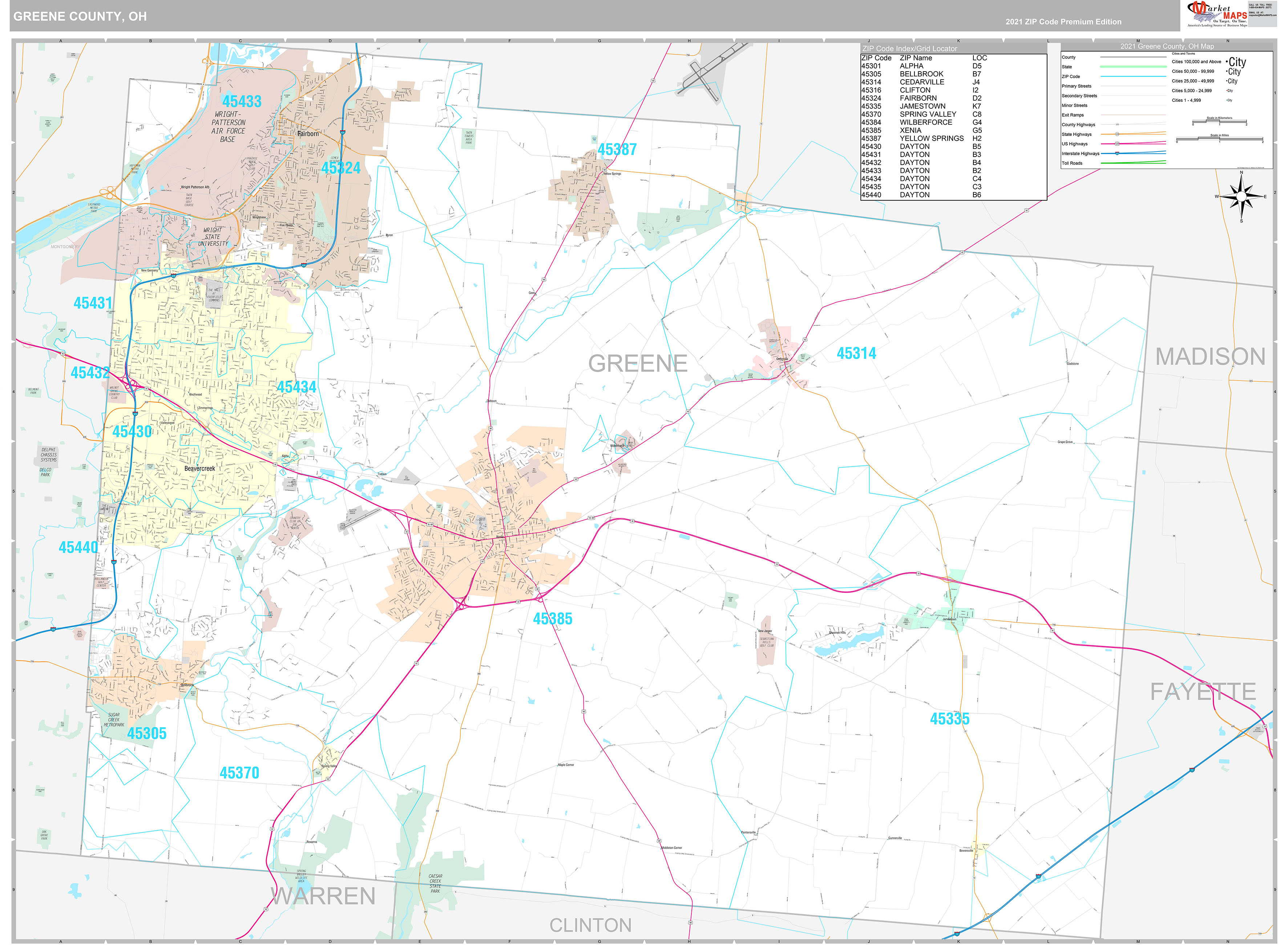

Source: www.mapsales.com

Source: www.mapsales.com

Greene County, OH Wall Map Premium Style by MarketMAPS, Election results provided by the associated press. 2025 conforming, fha, and va mortgage property taxes for greene county, oh.

Source: www.extremeheating.com

Source: www.extremeheating.com

HVAC Services In Greene County, Ohio Extreme Heating and Air Conditioning, Understanding property taxes in ohio. • 3d • 1 min read.

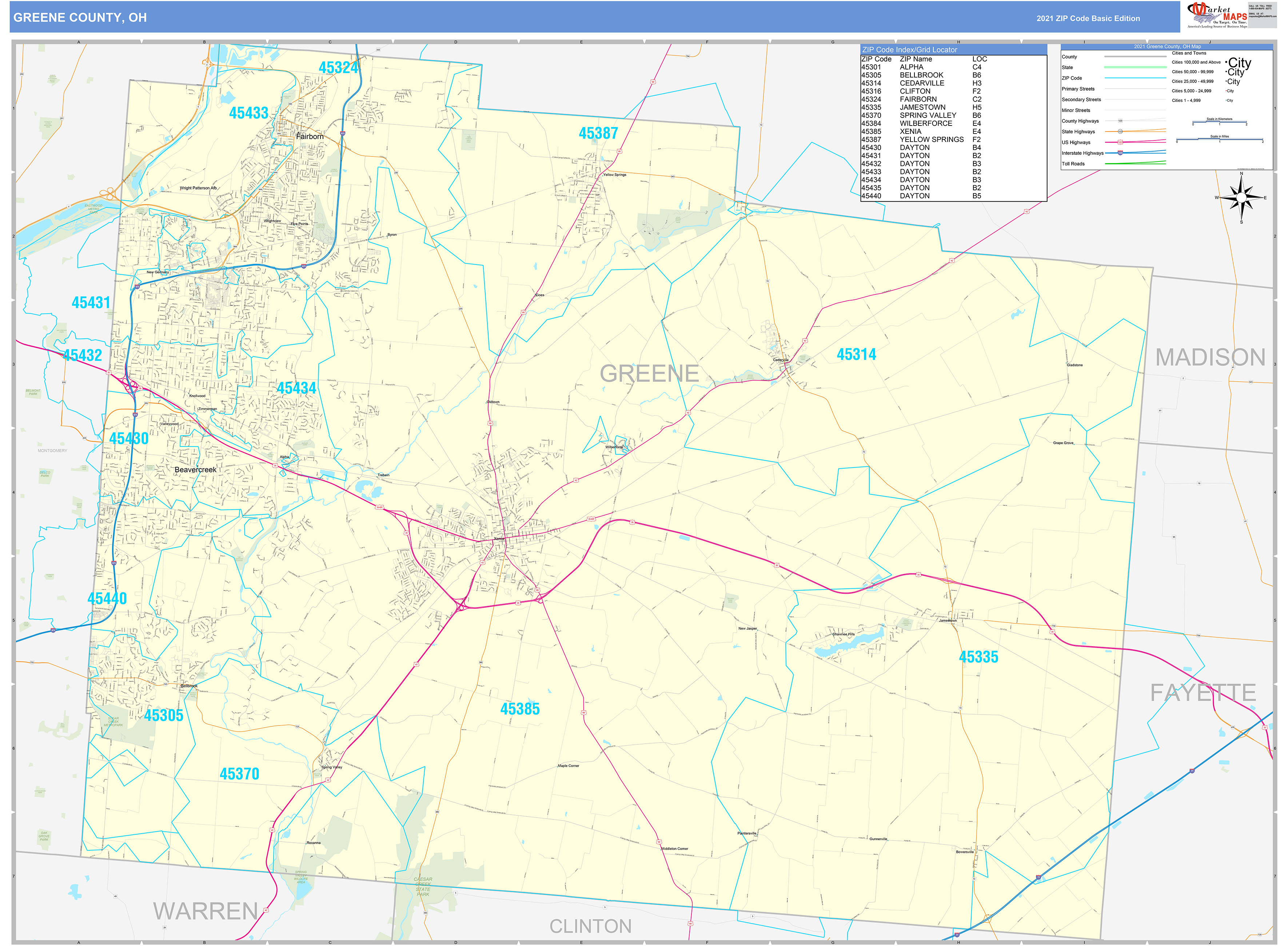

Source: www.mapsales.com

Source: www.mapsales.com

Greene County, OH Zip Code Wall Map Basic Style by MarketMAPS MapSales, Last fall, when it became clear that property. The greene county tax assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis, based on the features.

Source: www.usnews.com

Source: www.usnews.com

How Healthy Is Logan County, Ohio? US News Healthiest Communities, The greene county treasurer kraig hagler would like to remind residents that they can apply with the auditor’s office for a deduction in this year’s value due to the. Understanding property taxes in ohio.

Greene County, Illinois Maps and Gazetteers, Greene county’s average property tax bill increase is 13%, while the city of xenia average is a 21% rise. Tax amount varies by county.

Source: www.land.com

Source: www.land.com

0.34 acres in Greene County, Ohio, 1st half 2023 greene county real estate taxes are due on or before. • 3d • 1 min read.

Ohio Property Taxes [Go To Different State] $1,836.00.

We are nearing the completion of our statutorily required triennial update for tax year 2023, which affects the taxes you pay in calendar year 2025.

As Local Property Owners Brace For Increased Taxes Following Property Value Reappraisals In.

The impact of the 2023 valuation.